INTRODUCTION

The travel & tourism segment has become one of the key contributors to the global economy in recent years. Before Covid-19, travel & tourism accounted for 10.3% of the global GDP and was worth over USD 9 trillion (World Travel and Tourism Council, 2019). One out of four newly created jobs stemmed from this segment in 2019. (World Travel and Tourism Council, 2019).

Consequently, Bahrain aims to become a major tourism hub in the region. The Kingdom seeks to implement strategies and policies to boost its tourism segment, provide a competitive edge, and stimulate the local economy. This will create more jobs and diversify economic activity even further away from hydrocarbon-based activities.

In this article, we will assess the current scenario of Bahrain's tourism segment and discuss potential challenges that may impact the prospects of local tourism in the future. This article will be divided into the following sections: An overview of Bahrain's tourism segment, An analysis of the current tourist portfolio, and a discussion & policy recommendations.

An Overview of Bahrain’s Tourism Segment

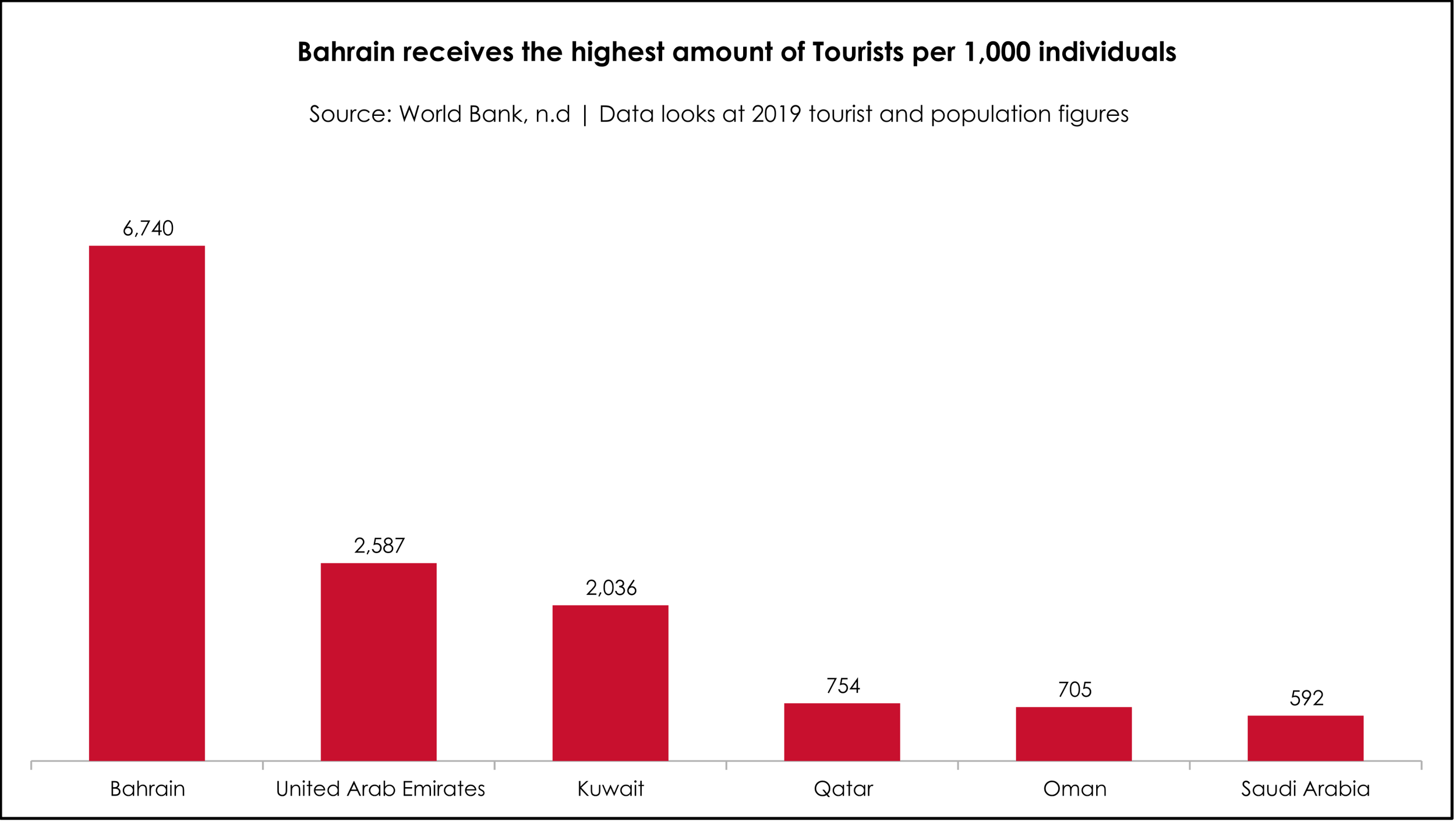

Bahrain is the smallest and only island country in the GCC region. Relative to its neighbors, some regulatory policies are more “relaxed”, such as surrounding the consumption of alcohol and other activities (gov.uk, n.d), making it a more compelling tourist destination within the GCC. As a result, we can see that the more “liberal” rules and regulations are associated with some of the highest inbound tourism figures:

Since 2011, the number of inbound visitors to Bahrain has been rising, from 6.7 million tourists to approximately 11.1 million tourists by 2019. This marks a growth rate of roughly 6.4% since 2019 (World Bank, n.d). As an objective, the government plans to continue to increase the number of tourists to cross the 14.1 million mark by 2026 (BTEA, 2021). We also see that tourists specifically prefer Bahrain for holiday, leisure, and shopping purposes as an average of more than 71% of total tourists during the last five years arrived in Bahrain for these purposes (IGA Bahrain, n.d.). The importance of tourism is that tourism spending has increased since 2011 in both absolute and relative terms, with absolute figures increasing from 1.8 billion USD to 3.9 Billion USD in 2019, and per capita from 262USD per visitor to 349USD per visitor in 2019 (World Bank, n.d).

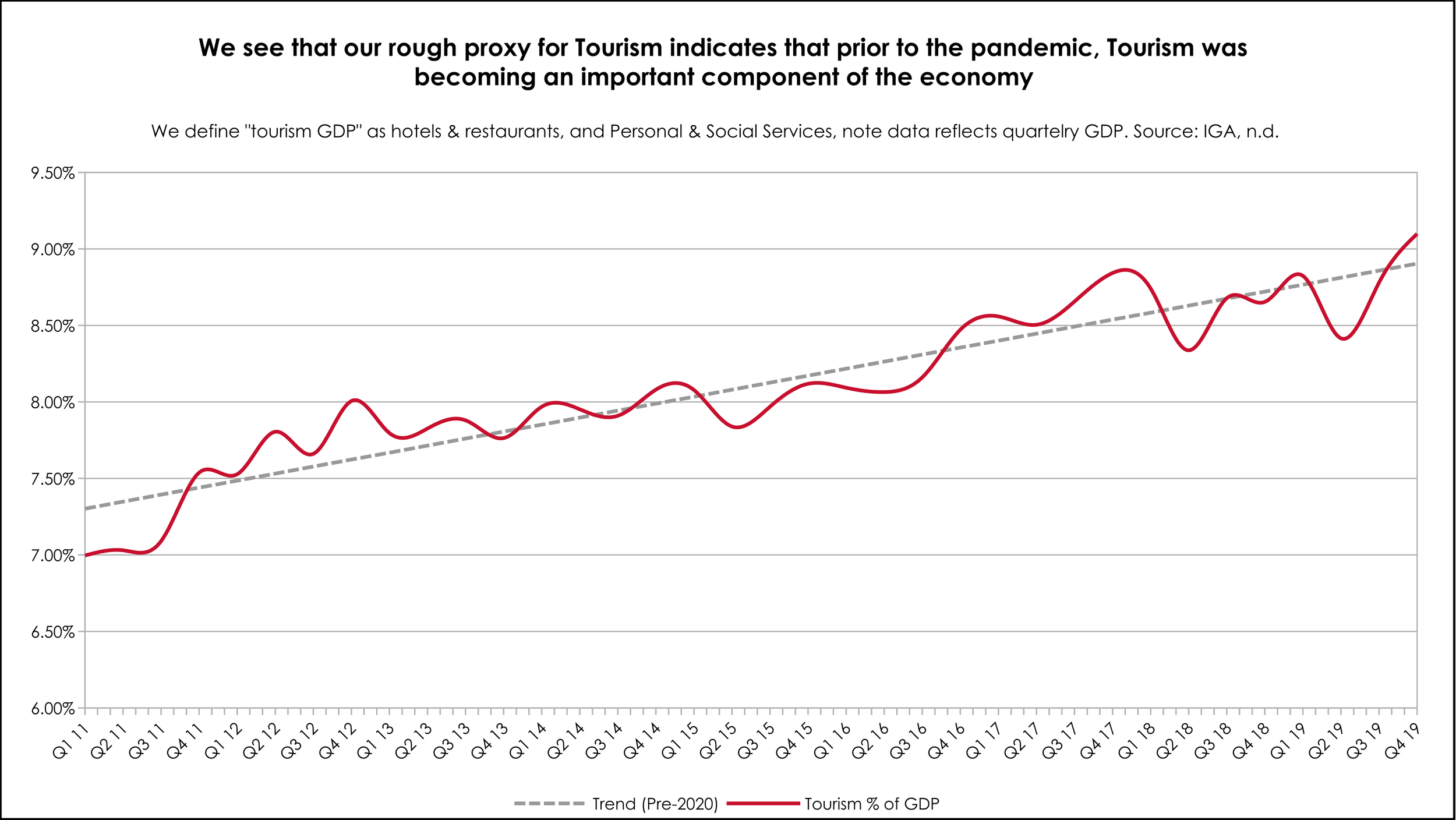

The increase in tourism spending in absolute and relative terms has important implications for the economy. Suppose we define restaurant & hotels, and personal & social service GDP as a rough proxy for the “tourism” sector. We see that tourism before the pandemic was becoming a more prominent component of the economy:

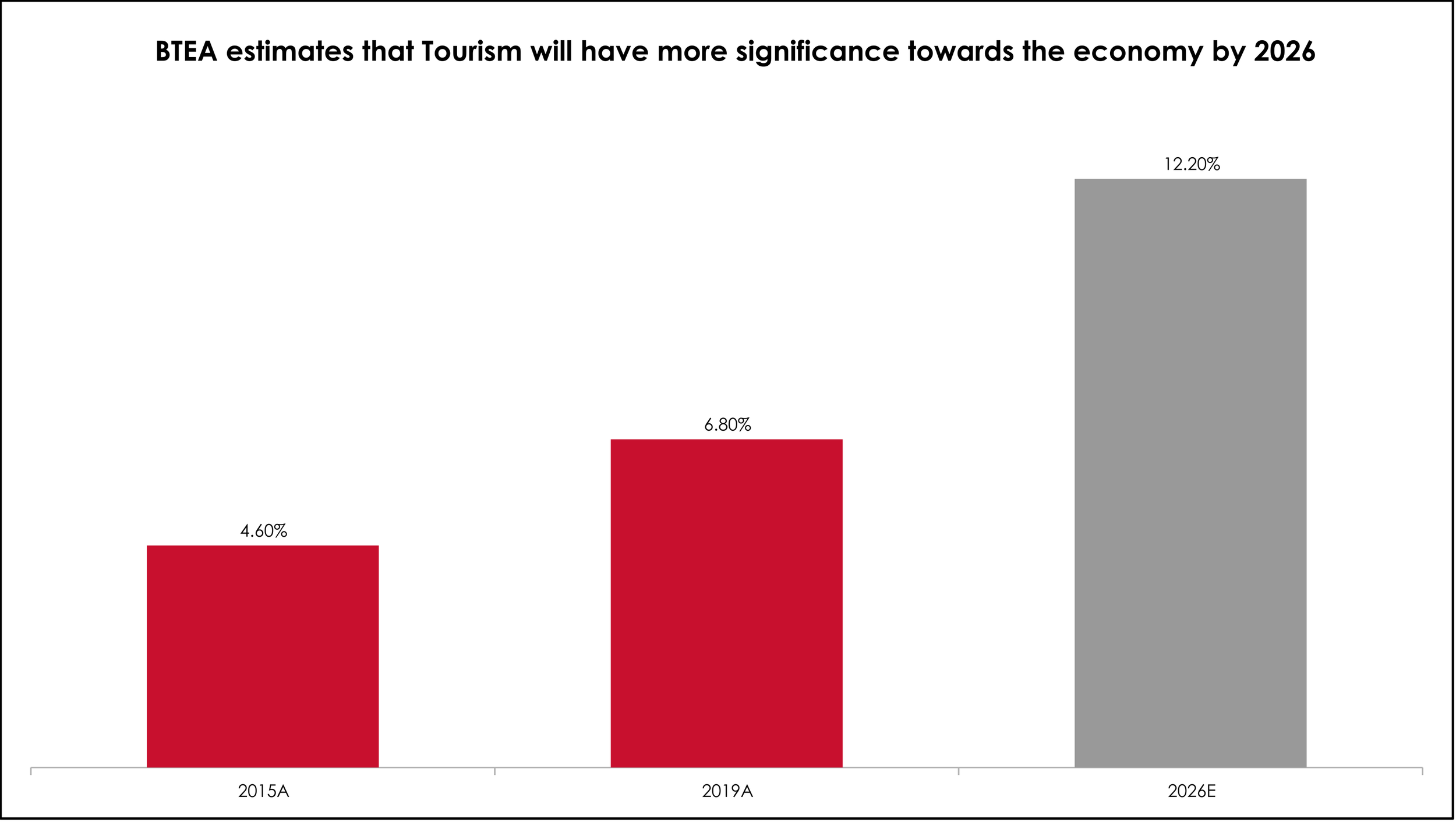

Furthermore, looking at the BTEA projection of the percentage of tourism as a percentage of GDP (note, BTEA defines the tourism sector differently than how we define the tourism sector above), we see that the tourism sector is indicated to be a significant contributor to the economy by 2026:

Amidst the recent improvement in the local tourism metrics, along with the expectation that Bahrain would emerge as the region's next tourism hub, the country's hospitality segment has been expanding its capacity. Local hotels have increased the number of available rooms by 14% from 2015 to 2019, whereas the number of total bed places has grown by 28% (IGA, n.d), indicating that the tourism sector has a positive outlook moving forward into the future.

Although Bahrain's tourism sector and its figures have significantly improved over the past ten years, there are potential challenges it may face. The largest is the tourism segment's lack of diversity in its tourist portfolio. In the next section, we will explore the data regarding significant reliance on GCC tourists and what challenges this may pose.

RELIANCE ON GCC TOURISTS

Bahrain is a regional connecting hub with a flight time of less than an hour from all GCC countries. The country is also linked with Saudi Arabia, the largest economy in GCC, via the King Fahad Causeway, which makes it convenient to commute between the two countries via road. On average, nearly 89% of tourists arrive via the causeway between 2015 and 2019. Furthermore, Bahrain relies on 88% of its total inbound visitors from Saudi Arabia (on average between 2015 and 2019) (IGA, 2021).

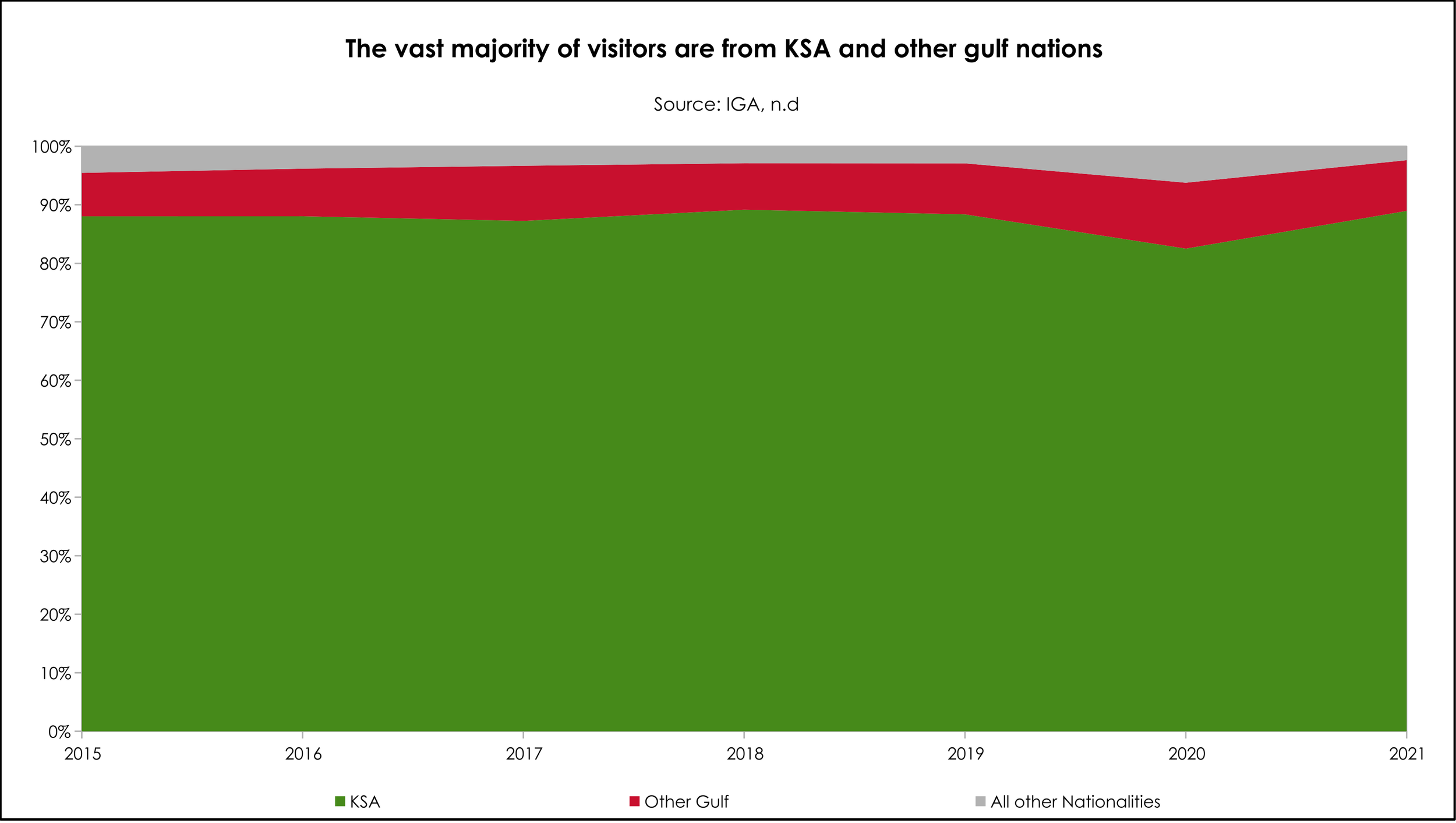

As previously mentioned, the Kingdom appears to have more “relaxed” rules and regulations surrounding the consumption of alcohol and other entertainment avenues, which makes it an attractive tourist destination. Looking at the data, we can see that the vast majority of tourists originate from Saudi Arabia and other GCC nations:

When comparing other GCC nations, we see that the portfolio of Bahrain is less diversified. For example, tourists from the top 5 origins only accounted for 40% of the total tourists inflow to UAE, 43% for Oman, 42% for Saudi Arabia, and 70% for Kuwait (World Travel and Tourism Council, 2019). Comparing this to Bahrain, we see that, on average, 96% of all tourist inflows are from GCC nations. This leads to two key challenges: lower international tourism receipts by inbound visitors and the potential for a decreased inflow if and when other GCC nations develop their tourism industries.

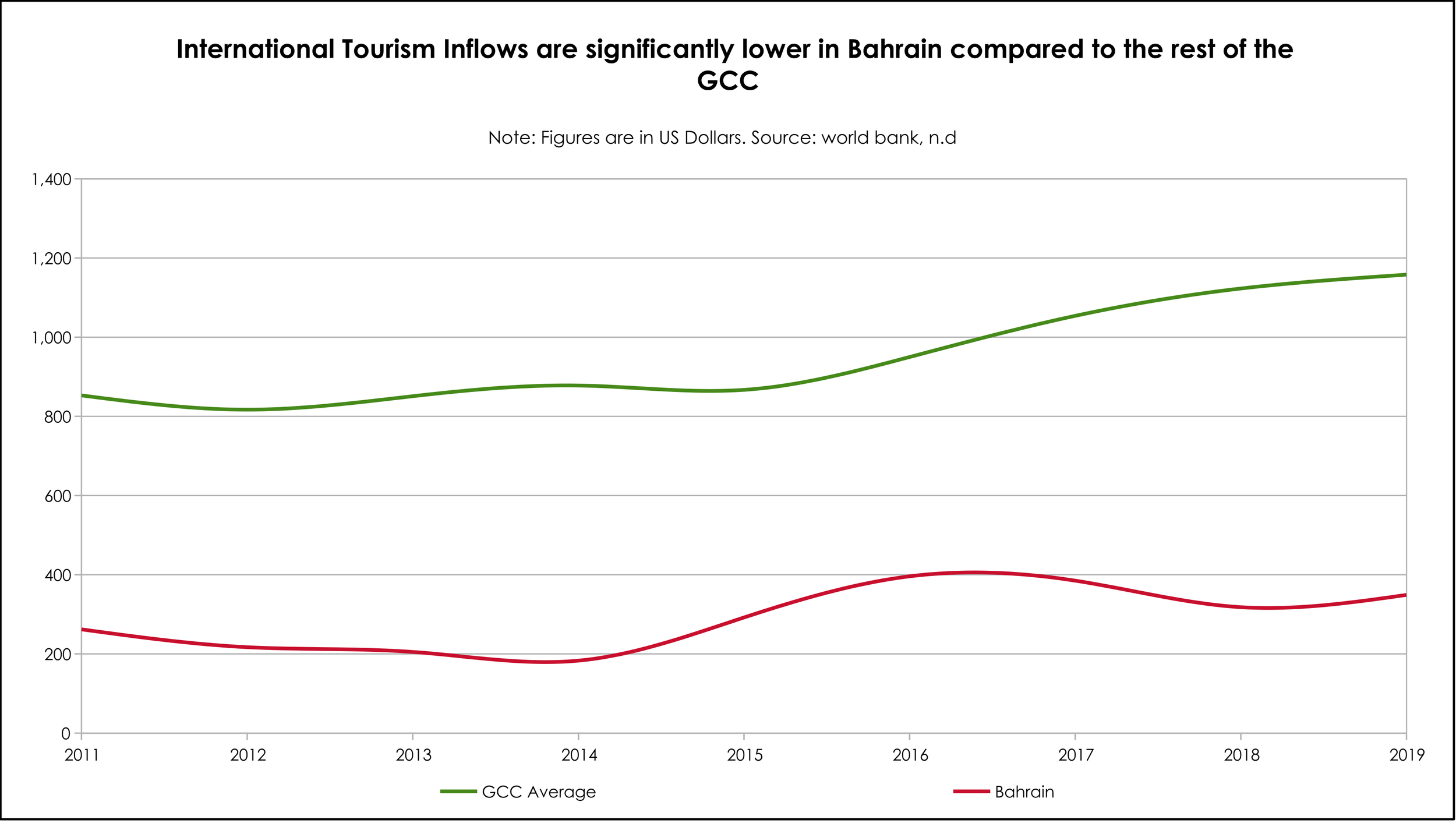

We can define international tourism receipts as “expenditure of international inbound visitors in the country including their payments to national carriers for international transport. They also include any other payments or payments afterwards made for goods and services received in the destination country”. Looking at the data, we can see that Bahrain is the 2nd lowest GCC nation in terms of international tourism receipts per visitor:

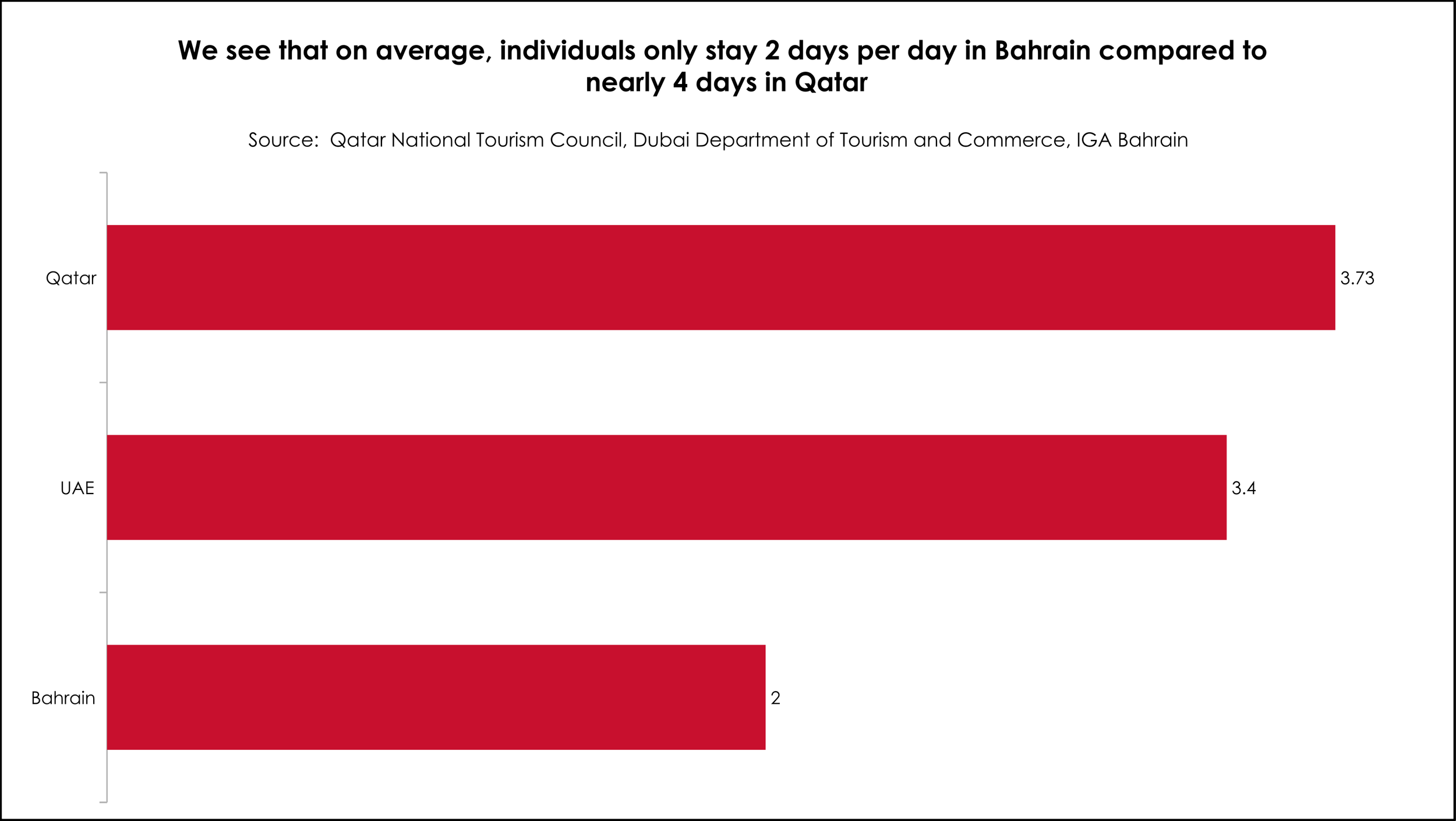

Given that the vast majority of foreign visitors arrive via the King Fahad causeway, the below-average tourism expenditure is certainly not unusual given the lack of spending on air & domestic transport. As of 2019, only 6.5% of the total international tourism receipts were spent on air & domestic transport and car rentals (IGA Bahrain, 2021). Another reason for lower spending by inbound visitors is that the visit duration is generally lower than in other GCC nations:

The combination of lower spending on transportation and less visiting time may explain the lower expenditure inflow compared to the rest of the Gulf. In the next part, we will analyze potential challenges arising from a reliance on GCC tourists.

Potential challenges that may arise from a reliance on GCC tourists:

From the above, we've established that Saudi Arabia accounts for nearly 88% of inbound visitors on average between 2015 and 2021, and Other Gulf nations account for nearly 9%. While reliance on neighboring countries is not a necessary problem given the tight interlink between gulf nations in terms of culture and socio-economic characteristics, challenges may arise due to changes in other GCC nations' domestic tourism conditions.

Primarily looking at Saudi Arabia, approximately 30 billion USD have been spent abroad annually on entertainment and leisure in other parts of the GCC (Saudi Ministry of Tourism, 2020). Hence, the theme of investing in the local entertainment and leisure segment is a lucrative economic strategy. As a result, Saudi Arabia aims to increase the contribution of its “tourism” sector towards GDP from the current 3% to well over 10% by 2030, which includes over 1 trillion US Dollars worth of investments in several new entertainment and leisure projects (Saudi Ministry of Tourism, 2021). Before 2018, there were no cinemas in Saudi Arabia; however, nearly 40 cinemas are planned to be available across the Kingdom over the next five years, and Dubai’s VOX cinema aims to develop 600 screens in Saudi Arabia (Mubasher, 2019). Furthermore, the Kingdom has had 100 concerts in 2019, which is aimed to increase by up to 600% by 2022. (Saudi Ministry of Tourism, 2021).

With the increased development of Saudi Arabia's domestic tourism market, there may be a potential for consumers from Saudi Arabia and other Gulf nations to substitute their visits from Bahrain towards Saudi Arabia's tourism market or their domestic tourism market if similar developments are occurring in such markets. The extent of such a substitution effect is unknown now; however, it will likely be significant. Therefore, some potential policy recommendations are needed to counter what appears to be an "inevitable" substitution by Saudi and other gulf country consumers.

Policy Recommendations and Conclusion

While the development of Saudi Arabia's tourism market may appear to be a challenge to Bahrain's tourism industry, it is important to stress that such a perception is what it seems to be. It is important to note that the potential development of Saudi Arabia's tourism sector could also positively impact Bahrain's tourism industry. For example, say that the development of Saudi's tourism industry attracts international visitors. This, in turn, could create a "spillover" effect of tourists either stopping by Bahrain or potentially also visiting Bahrain and other Gulf nations. Nevertheless, it is important that the substitution effect we have discussed above is likely to be present and may outweigh any increase in potential spillover effects from increased international tourism elsewhere in the Gulf.

As for policy recommendations, this article recommends that Bahrain should not only attempt to diversify its tourist portfolio away from GCC nationals but also be applied to the rest of the Gulf. Given the similar historical, cultural and socioeconomic ties that Gulf nations have, potentially advertising tourism across the Gulf rather than each Gulf nation can benefit each member state under a unified “tourism” banner. This will allow each member state to decrease its reliance on regional tourism (Gulf nationals) and increase tourism from international sources. This, in turn, will enable the GCC to have a competitive international tourism destination while providing a domestic tourism sector for each member state.

In conclusion, we have seen that the “tourism” sector is an essential component of the Bahraini economy and will continue to do so going forward. However, we have also seen that the largest potential challenge is the reliance on Saudi Arabia and Gulf nationals as its tourism portfolio, which with the recent developments of domestic tourism in other Gulf nations, could lead to a decrease in future inflows of visitors from around the Gulf. Therefore, as recommended above, a solution that will benefit not only Bahrain but the entire Gulf region is to potentially create a campaign and policy framework that promotes Gulf tourism around the whole region towards international tourists instead of each Gulf nation attempting to promote individual domestic tourism as one.

ABOUT THIS AUTHOR

Saim is a corporate finance and strategy professional with over 3 years of experience. He has a penchant for development economics and an inclination towards policy making.

Email: saimahmed987@gmail.com